He married Eleanor Dawn Barefoot on July 6, 1958.

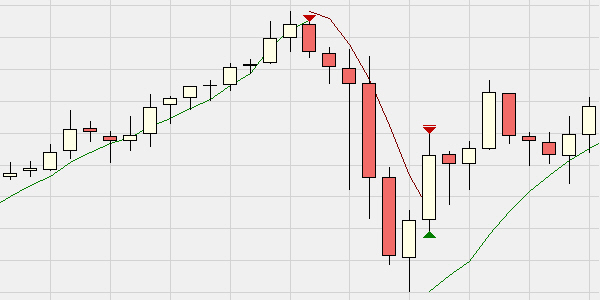

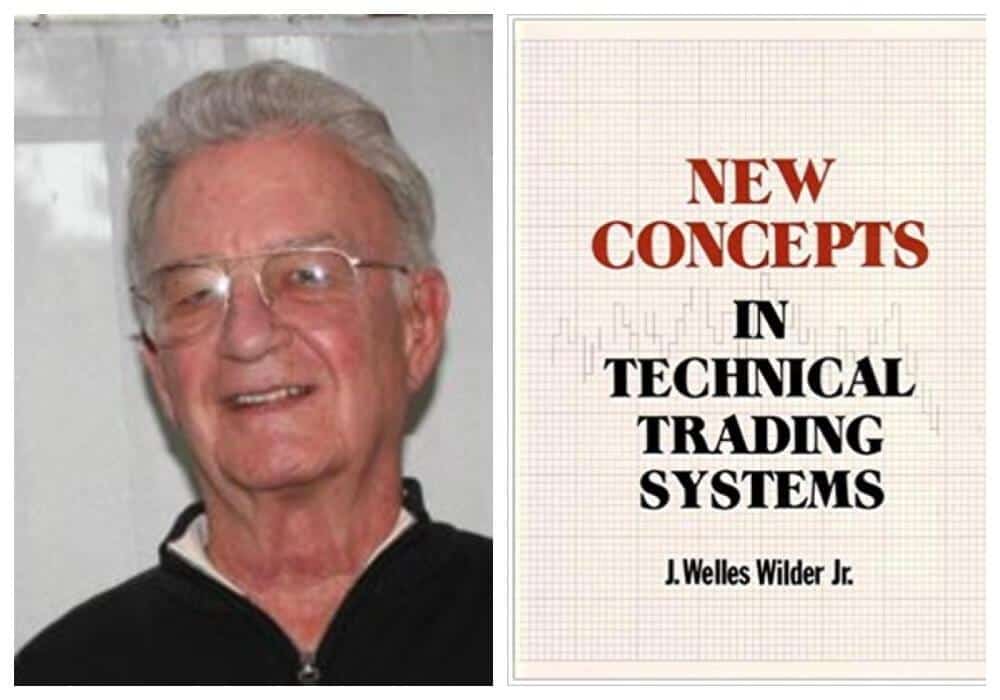

The oldest of four children to John Welles "Jack" Wilder, Sr., and Frances Green Wilder, his brother was former NFL Defensive Tackle and Defensive End Albert Green "Bert" Wilder (Ap– December 5, 2012).Īfter serving in the Korean War in the US Navy, Wilder attended North Carolina State University in Raleigh, graduating with a degree in Mechanical Engineering in 1962. John Welles Wilder was born Jin Norris, TN. These include Average True Range, the Relative Strength Index (RSI), Average Directional Index, and the Parabolic SAR. Wilder is the father of several technical indicators that are now considered to be the core tenets of technical analysis software. He is best known, however, for his work in technical analysis. (J– April 18, 2021) was an American mechanical engineer, However, the RSI is a useful tool to employ under certain market conditions.J. Oscillators are not perfect and are certainly not the “Holy Grail” that some traders continually seek. However, I still would not use an oscillator, under this circumstance, to enter a long-side trade in straight futures, as that would be trying to bottom-pick. If the readings are extreme-say a reading of 10 or below on the RSI-that is a good signal the market is well oversold and could be due for at least an upside correction. I also like to look at the oscillators when a market has been in a longer-term downtrend. I can pretty much tell by looking at a bar chart if a market is “extended” (overbought or oversold), but will employ the RSI to confirm my thinking. I do look at oscillators when a market has been in a decent trend for a period of time, but not an overly strong trend. At that point, it’s likely that an oscillator such as the RSI would show the market as being overbought and possibly generate a sell signal-when in fact, the market is just beginning to show its real upside power. Another example of oscillators not working well is when a market trades into the upper boundary of a congestion area on the chart and then breaks out on the upside of the congestion area. They can show a market at either an overbought or oversold reading, while the market continues to trend strongly. Oscillators tend not to work well in markets that are in a strong trend. My “primary” trading tools include chart patterns, fundamental analysis and trend lines. I tend to use most computer-generated technical indicators as secondary tools when I am analyzing a market or considering a trade. I use it in certain situations, but only as a “secondary” tool. However, I treat the RSI as just one trading tool in my trading toolbox. In addition, the study can highlight support and resistance zones.Īs you just read above, some traders use these oscillators to generate buy and sell signals in markets-and even as an overall trading system. They are trendlines, head and shoulders, and double tops and bottoms. Common bar chart formations readily appear on the RSI study. The RSI exhibits chart formations as well. A failure swing or divergence accompanies the best trading signals. But it does not, in itself, indicate a top or a bottom. A move to those levels is a signal that market conditions are ripe for a market top or bottom. Selling when the RSI is above 70 or buying when the RSI is below 30 can be an expensive trading system. Divergence may occur in a few trading intervals, but true divergence usually requires a lengthy time frame, perhaps as much as 20 to 60 trading intervals. Market prices continue to move higher/lower while the RSI fails to move higher/lower during the same time period. For example, the market makes new highs after a bull market setback, but the RSI fails to exceed its previous highs.Īnother use of the RSI is divergence. While you can use the RSI as an overbought and oversold indicator, it works best when a failure swing occurs between the RSI and market prices.

Conversely, a low RSI, below 30, implies an oversold market or dying bear market. A high RSI, above 70, suggests an overbought or weakening bull market. The main purpose of the study is to measure the market's strength or weakness. The Relative Strength Index (RSI ) is a J. I’ll define and briefly discuss the RSI, and then I’ll tell you how I use it in my market analysis and trading decisions. (An oscillator, defined in market terms, is a technical study that attempts to measure market price momentum-such as a market being overbought or oversold.) One of the more popular computer-generated technical indicators is the Relative Strength Index (RSI) oscillator. Kitco News Sharpening Your Trading Skills: The Relative Strength Index (RSI)

0 kommentar(er)

0 kommentar(er)